Brasília – The federal government’s plans of leasing the ports of Santos, in the state of São Paulo, and Santarém, Outeiro, Vila do Conde, Belém and Miramar, in Pará state, will cause the terminals’ combined capacity to reach 48 million tonnes. The measure is part of the new ports act, passed two months ago. Investment forecasts in ports in the two states amount to a combined R$ 3 billion (US$ 1.3 bn), the special secretary for Ports minister Leônidas Cristino said this Friday (9th).

The government is not working with a fixed rate of return for investors, but estimates it should be around 7%, said the Chief of Staff minister Gleisi Hoffmann on announcing the launch of a public consultation that should last 30 days, designed to fine-tune studies on the rate of return. “There is no set rate of return. Studies have shown it should be around 7%, but most of the tenders will be based on throughput capacity. Provided that the contracts meet all of the requirements, then the rate of return may be much higher, and the government has no problem with that whatsoever,” Gleisi explained.

According to the minister, the leases are meant to meet demand, cut costs and make Brazil a more competitive country. At the Santos port, R$ 1.39 bn (US$ 603 mn) will be invested in boosting last year’s capacity (105 mn tonnes) by 27 mn tonnes. a total of 11 terminals will be tendered for lease in 20 different areas. In the area destined for grain alone, R$ 473 mn (US$ 205) should be invested, leading to a 77% increase in capacity, from the current 14.7 mn tonnes to 26 mn.

The Port of Santos should also see R$ 190 mn (US$ 82.4 mn) in investment in areas destined for fertilizer transport, leading to a 28% increase in capacity from 6.1 mn tonnes to 7.8 mn. Liquid bulk transport areas should see R$ 304 mn (US$ 132 mn), leading to a 74% capacity increase, from 11.1 mn tonnes to 19.3 mn.

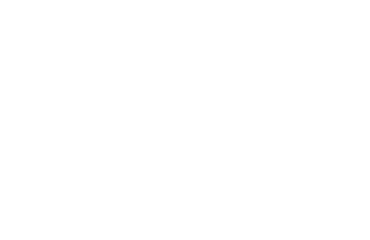

The five ports in the state of Pará (Santarém, Outeiro, Vila do Conde, Belém and Miramar) should see R$ 1.6 bn (US$ 694 mn) and 20 areas should be leased. As a result, throughput capacity should increase by 21.2 mn tonnes from last year’s 22.4 mn tonne throughput.

Financing will be provided by the Brazilian Development Bank (BNDES) to the tenders’ winning companies. Interest rates will consist of the Long Term Interest Rate (TJLP, in the Portuguese acronym) plus up to 2.5%. A 3-year grace period and up to 20 years of amortization will be granted. The leverage ratio will be 65%. The public consultation will open next Monday (12th) and close on September 6th. The call for tender should be issued on October 25th.

*Translated by Gabriel Pomerancblum