São Paulo – Yerba mate produced in the Brazilian state of Paraná was the subject of a seminar this Tuesday (11) organized by the state’s investment program, Invest Paraná. Arab Brazilian Chamber of Commerce (ABCC) economist Sotirios Ghinis spoke about the paths to the Arab market at the event. He pointed out there is demand in the Arab countries for yerba mate, and Brazil could export more of the product to the region.

According to the economist, the leading importers of yerba mate among the 22 Arab countries in 2021 were Syria, Lebanon, Saudi Arabia, Jordan, and the United Arab Emirates. The primary exporters of the herb to the Arabs in the same year were Argentina, Paraguay, Germany, and the United States. The Arabs imported USD 50.71 million in mate, equivalent to 24% of world imports in 2021, and of these, Brazil sold only USD 74,000 to them.

In 2022, the result was even smaller. Brazil exported to the Arabs USD 1,000 last year, equivalent to 0.001% of its mate exports. The primary destinations were the UAE, Qatar, and Bahrain. Data are from the Brazilian Ministry of Development, Industry, Commerce, and Services and the International Trade Center (Intracen).

“Searching for yerba mate (HS6 090300) through the harmonized system code, I was negatively surprised by the number of our exports to that region. It is a meager number, and from January to March this year, exports from Brazil to the Arab countries were none,” said Ghinis.

The economist informed there is direct Syrian investment in Argentina, where they produce, and the herb is exported directly to Syria and Lebanon. “Producers in Paraná could think of attracting investments along these lines. There is value in the production, which deserves to be explored,” he said.

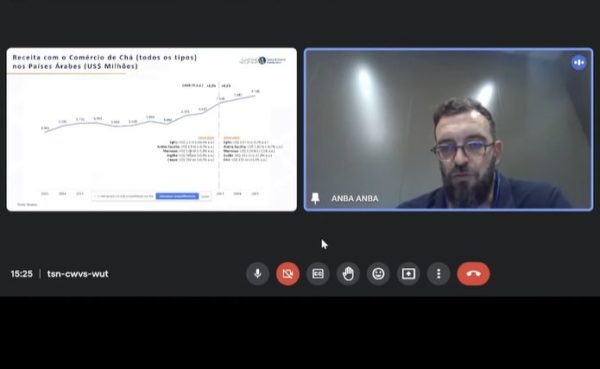

Despite the low numbers, there is potential for yerba mate, as the Arabs are great tea consumers. Trade revenue in all kinds of tea in the Arab countries from 2013 to 2022 grew 3.3% per year, on average. The primary consumers were Egypt, Saudi Arabia, Morocco, Algeria, and Iraq. The projection for the 2023 to 2025 period is for an average 4.1% a-year expansion, with Egypt at the forefront, followed by Saudi Arabia, Morocco, Sudan, and the UAE.

Ghinis said in negotiating with the Arabs, eye-to-eye contact is highly valued, and businesspeople should go to these markets to meet potential clients. He recalled many Arab countries, such as the UAE, are re-export hubs for the region, with free trade agreements with Africa, Asia, the European Union, and the United States. “In addition to being in a strategic location, maintaining an excellent infrastructure and having incentives for foreign direct investment (FDI),” he said. He reinforced the Arab free zones can be used as a sales hub for the global Muslim market, which will represent a third of the world’s population in 2030.

The economist presented the ABCC’s services and the upcoming events the organization will participate in. Among them are the APAS show, in May, in São Paulo; the mission to South Africa in June; the Mihas halal show in Malaysia in September; the Global Halal Brazil (GHB) forum, in October, in São Paulo; and the Saudi Halal Expo fair, in November, in Saudi Arabia.

The event was held by Invest Paraná, the state government of Paraná, and the State University of Londrina’s (UEL) Interdisciplinary Center for Public Management (NIGEP).

Translated by Elúsio Brasileiro