São Paulo – Egypt remains the third biggest market for Brazilian beef, although sales slowed down somewhat in the last few months, partly due to the fact that some meat packers got the green light to export to China, said Brazilian Beef Exporters Association (Abiec) chairman Antônio Camardelli during a press conference this Tuesday (10). The country is outdone only by China and Hong Kong in buying beef from Brazil.

Year-to-date through November, sales from Brazil to Egypt were down 3.39% in revenue and 3.68% in volume, to USD 463.8 million and 158,560 tons. November saw the sharpest drop in the year, with 4,957 tons sold for USD 14.753 million, down from 18,501 tons in November 2018.

“Exports to Egypt went down a lot in 2019 because Egypt is a country that looks for average-low prices. Since beef prices have really increased in the last few months, we’re having some trouble, and there’s a possibility they’ll buy from India instead,” said Camardelli.

Abiec executive director Liège Nogueira told ANBA that China impacted exports to Egypt because both countries buy the same type of beef product from Brazil – culinary and ingredient beef – which is lower priced. “The only difference is that China requires livestock to be up to 30 months old, while other countries don’t, including Egypt. So you have animals that don’t ship to China, and they’ll ship to those markets instead. China requires younger animals,” she explained.

According to Camardelli, China influences the decline in exports to Egypt and other markets. “It’s a question of supply and demand. If you have bigger demand at flat prices and a successful commercial operation, the entire profitable production cycle, to this day we never had any news of non-payment,” the executive said regarding China.

He explained that it’s more profitable for the industry to sell at broader scales. That’s why China ends up taking the market away from other countries. “Some products are much more operational. For instance: Egypt and some other countries will buy more of the cheaper products, so that will get you working doing one-kilogram packages. And then when you’re deboning you need the staff to do the packing, so [with China] everything flows faster,” he said.

“Another thing we’re doing with some countries is supplying the armed forces. Egypt is one of them, and we recently had a tender in Morocco. A market is a market,” he said.

UAE

Year-to-date through November, exports from Brazil to the UAE climbed 135.11% in revenue and 155.23% in volume to USD 246.2 million and 67,900 tons, even though sales have eased over the last three months. The Arab country is the sixth biggest market for Brazilian beef.

“Regarding the UAE, it has always purchased consistently. This increase came because we’re also shipping product to the UAE that goes into Iran via trucks. Much fo sales to Saudi Arabia, Jordan and Turkey also end up in Iran. In the case of the UAE, since Dubai is a free port, you can ship to other countries, like Iraq,” he said.

Saudi Arabia

Saudi Arabia was the ninth biggest importer of beef from Brazil, with shipped volume dropping 0.89% to 38,132 tons and revenue going down 30.6% to USD 128.29 million through November.

Camardelli imputed the drop in exports to Saudi Arabia to some changes in paperwork requirements. “We went to a rough patch since they changed their management processes. We pledged to provide guarantees in the form of different technical analyses. And then you also had a few changes in the certification process. It’s a very interesting country, because it will buy a lot of hind quarter cuts, and that makes for evenly balanced sales,” he said.

The Arab bloc

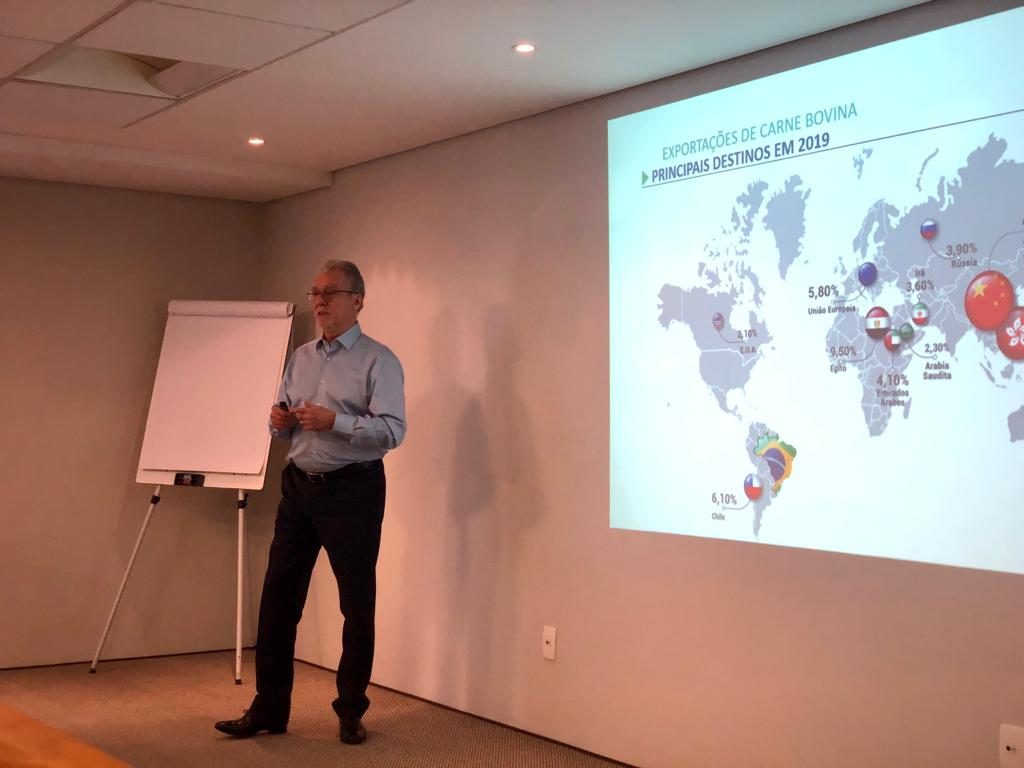

Taken as a bloc, the 22 Arab countries ranked second after Hong Kong. Through November, those countries took in 337.340 tons of beef products from Brazil, up 9,3% year-on-year, with imports amounting to USD 1.1 billion, according to numbers from the Arab Brazilian Chamber of Commerce Market Intelligence department. China’s imports came out to USD 2.17 billion during that time.

Total exports

Beef exports from Brazil are expected to end the year at a record USD 7.5 billion, up 13.3% from 2018. Shipped volume is seen climbing 11.3% to 1.83 million tons.

Exports through November hit 1.673 million tons, up 12.3% from a year ago, with revenue climbing 12.6% to USD 6.748 billion.

November-only exports amounted to 179,948 tons, up 13.8% year-on-year, with revenue going up 36.7% to USD 847.54 million.

“Brazil is the only major player today that can provide the volume, the average pricing, the quality, but we could also meet the demand in a much more profitable niche, which is prime beef,” said Camardelli.

Exports are expected to amount to 25% of total production in Brazil this year – an unprecedented rate, since the usual range is 20% to 22%.

As for next year, Camardelli said prices should level out and find a point of equilibrium between the domestic and international markets. “We won’t see the same prices as in this November-December spike, but it won’t go back to January-February levels either,” he explained.

The expectation for 2020 is for steady 15% growth in revenue, to USD 8.5 billion, and 13% growth in volume, exceeding 2 million tons, driven by the possible accreditation of additional plants to sell to China, the beginning of sales to new markets, like Indonesia, and the keeping of current markets.

Translated by Gabriel Pomerancblum